Navigating the Landscape of Aiken County: Understanding the Tax Map

Related Articles: Navigating the Landscape of Aiken County: Understanding the Tax Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Landscape of Aiken County: Understanding the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Aiken County: Understanding the Tax Map

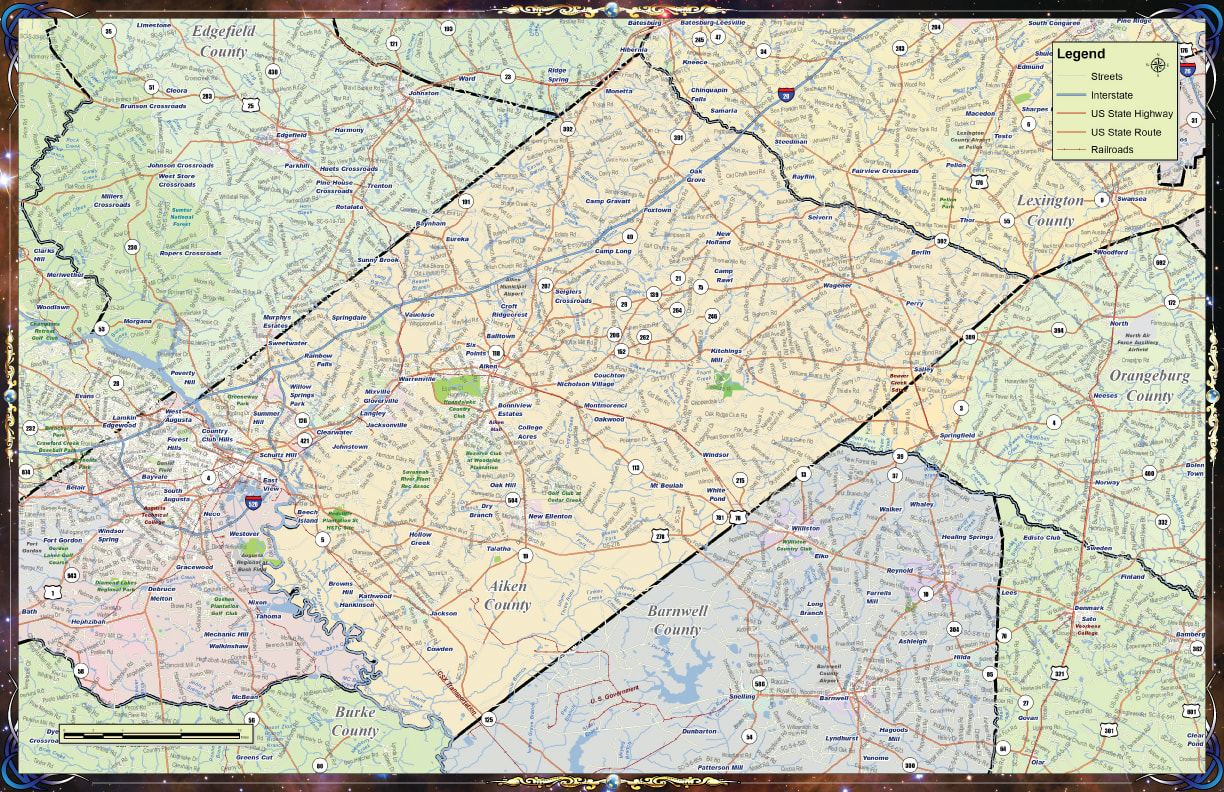

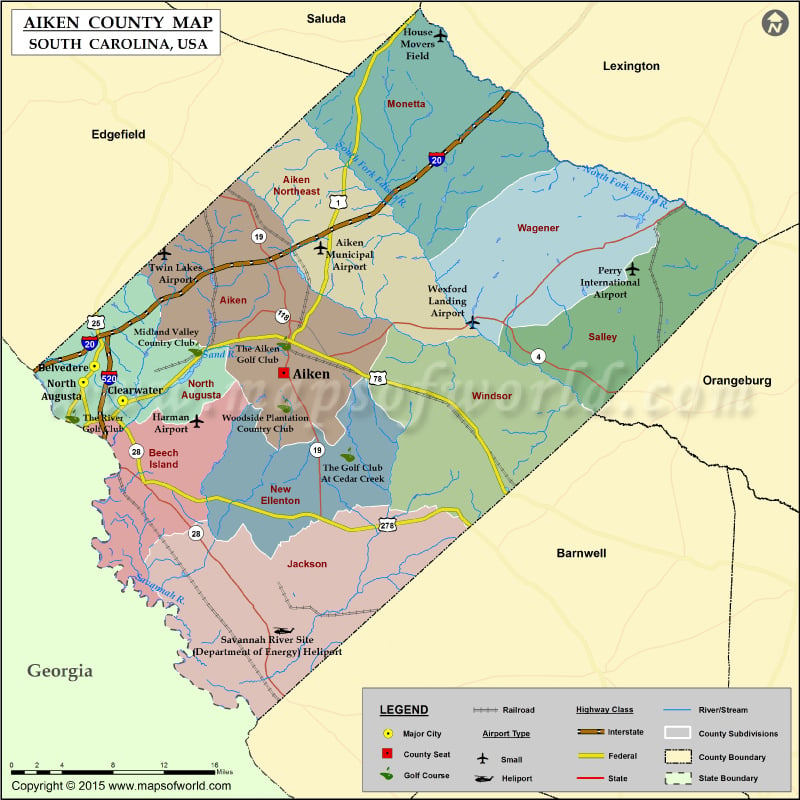

Aiken County, South Carolina, boasts a diverse landscape, encompassing rolling hills, sprawling forests, and bustling urban centers. This intricate tapestry of land is meticulously organized and documented through the Aiken County Tax Map, a vital resource for understanding property ownership, assessing tax liabilities, and facilitating land-related transactions. This article delves into the intricacies of the Aiken County Tax Map, exploring its structure, functionalities, and significance in the context of local governance and community development.

Deciphering the Grid: Structure and Content of the Tax Map

The Aiken County Tax Map is a comprehensive digital and printed document that visually represents the county’s land parcels. This intricate system divides the county into sections, townships, and individual parcels, each identified by a unique code. This code, known as the "Parcel ID," serves as the primary identifier for each property, linking it to a wealth of information housed within the tax map database.

The map itself is typically presented as a series of detailed maps, each covering a specific geographic area within the county. These maps depict property boundaries, roads, waterways, and other significant features, providing a visual representation of the land’s physical characteristics.

Beyond the visual representation, the Aiken County Tax Map database houses a vast amount of information related to each property. This data includes:

- Parcel ID: The unique identifier for each property.

- Owner Information: Names and contact details of the property owner.

- Property Address: Physical location of the property.

- Property Type: Residential, commercial, agricultural, or industrial.

- Land Use: Current designation of the land, such as residential, commercial, or vacant.

- Property Size: Acreage or square footage of the land.

- Assessed Value: Estimated market value of the property for tax purposes.

- Tax Information: Details regarding property taxes, including the tax rate and any outstanding balances.

This rich data set forms the foundation for various administrative and financial processes within Aiken County, making the tax map a vital tool for a multitude of stakeholders.

The Pillars of Governance: Importance of the Tax Map

The Aiken County Tax Map plays a critical role in various aspects of local governance and community development:

1. Property Taxation: The tax map is the cornerstone of the county’s property tax system. By accurately identifying and assessing property values, the map ensures equitable taxation, ensuring that property owners contribute their fair share to the county’s budget. This funding supports essential public services like schools, roads, and emergency services.

2. Land Management: The tax map serves as a comprehensive inventory of land parcels, facilitating efficient land management practices. It enables the county to track land ownership, development patterns, and environmental conditions, supporting informed decisions regarding zoning, development permits, and environmental regulations.

3. Economic Development: The tax map provides valuable insights into land availability, property values, and development potential. This information is crucial for attracting businesses, promoting investment, and fostering economic growth within the county.

4. Emergency Response: The tax map aids emergency responders by providing detailed information about property locations, access routes, and potential hazards. This information streamlines emergency response efforts, enhancing safety and minimizing response times.

5. Public Access and Transparency: The Aiken County Tax Map is typically accessible to the public, promoting transparency and accountability in government operations. Citizens can access information about property ownership, tax assessments, and development plans, fostering a more informed and engaged community.

Navigating the Map: Accessing and Utilizing the Resource

The Aiken County Tax Map is readily available to the public through various channels:

- Aiken County Assessor’s Office: The primary source for accessing the tax map, both online and in person.

- Online Mapping Platforms: Many websites, including the county’s official website, offer interactive maps that allow users to search for specific properties and view relevant information.

- Real Estate Professionals: Real estate agents and brokers utilize the tax map to access property details, assess values, and guide clients in property transactions.

To utilize the tax map effectively, users should familiarize themselves with the following:

- Parcel ID: The unique identifier for each property.

- Map Legend: Understanding the symbols and colors used on the map to represent different features.

- Search Functions: Utilizing the online map’s search tools to locate specific properties or areas.

- Data Interpretation: Reading and interpreting the data associated with each property, including owner information, assessed value, and tax details.

Frequently Asked Questions:

Q: What is the purpose of the Aiken County Tax Map?

A: The tax map serves as a comprehensive record of property ownership, land use, and assessed values within Aiken County. It is used for various purposes, including property taxation, land management, economic development, and emergency response.

Q: How can I access the Aiken County Tax Map?

A: The map is available online through the Aiken County Assessor’s Office website, and in person at the Assessor’s Office. It is also accessible through various online mapping platforms.

Q: What information can I find on the tax map?

A: The tax map contains a wealth of information, including property boundaries, owner details, property type, land use, assessed value, and tax information.

Q: How can I find the Parcel ID of a specific property?

A: You can find the Parcel ID by searching for the property address on the Aiken County Tax Map website or by contacting the Assessor’s Office.

Q: What is the significance of the assessed value listed on the tax map?

A: The assessed value is the estimated market value of the property for tax purposes. It is used to calculate property taxes.

Tips for Utilizing the Aiken County Tax Map:

- Familiarize Yourself with the Map: Spend time exploring the map’s structure, symbols, and search functions to become comfortable with its layout.

- Utilize the Search Functions: Take advantage of the online map’s search tools to quickly locate specific properties or areas of interest.

- Verify Information: Always double-check information obtained from the tax map with other sources, such as property deeds or official records.

- Contact the Assessor’s Office: If you have questions or need assistance, do not hesitate to contact the Aiken County Assessor’s Office for guidance.

Conclusion:

The Aiken County Tax Map is a fundamental tool for understanding the county’s land, property, and development landscape. It serves as a vital resource for local government, property owners, businesses, and the community at large, facilitating informed decision-making, promoting transparency, and supporting a thriving community. By utilizing this powerful tool, individuals and organizations can navigate the intricate tapestry of Aiken County’s land with clarity and efficiency.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Aiken County: Understanding the Tax Map. We thank you for taking the time to read this article. See you in our next article!