The Power of Data: Unveiling the Importance of GIS Tax Maps

Related Articles: The Power of Data: Unveiling the Importance of GIS Tax Maps

Introduction

With great pleasure, we will explore the intriguing topic related to The Power of Data: Unveiling the Importance of GIS Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Power of Data: Unveiling the Importance of GIS Tax Maps

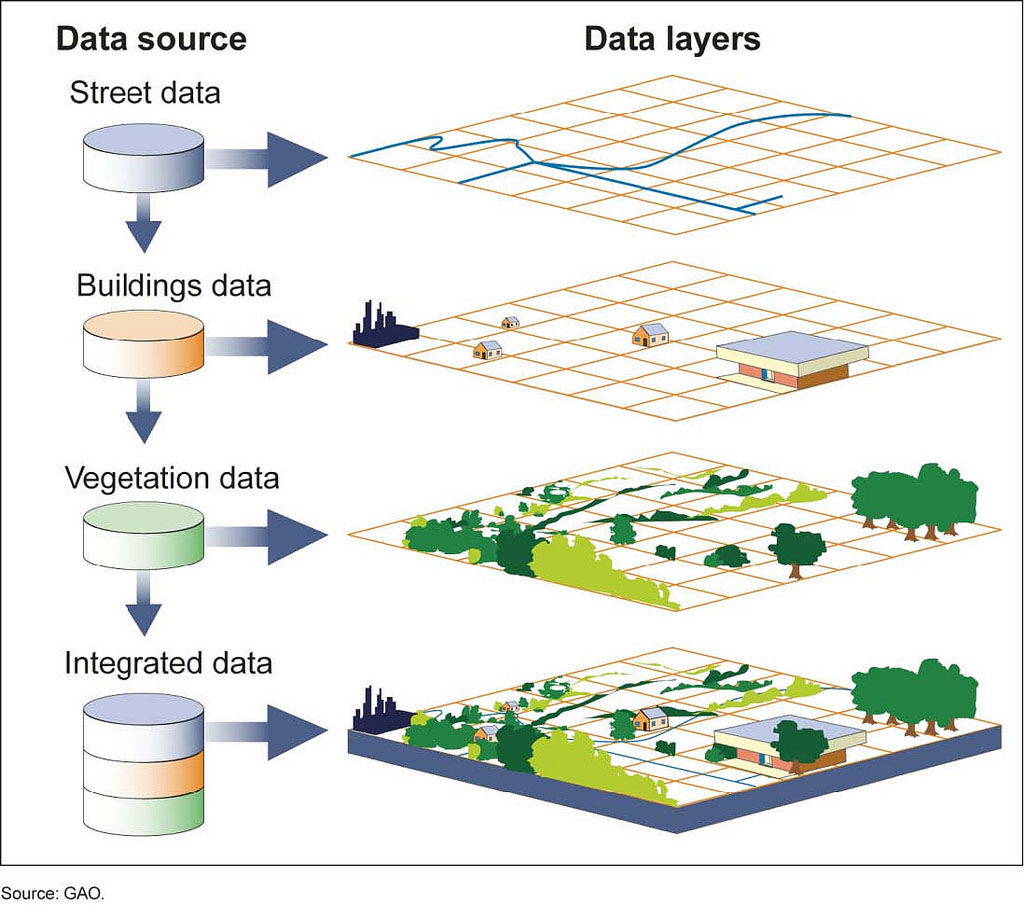

In the realm of property management and taxation, accurate and accessible data is paramount. Enter Geographic Information Systems (GIS), a powerful technology that transforms raw data into visually compelling and insightful maps. One of the most impactful applications of GIS is the creation of tax maps, a crucial tool for governments and individuals alike.

Understanding GIS Tax Maps: A Visual Representation of Property Data

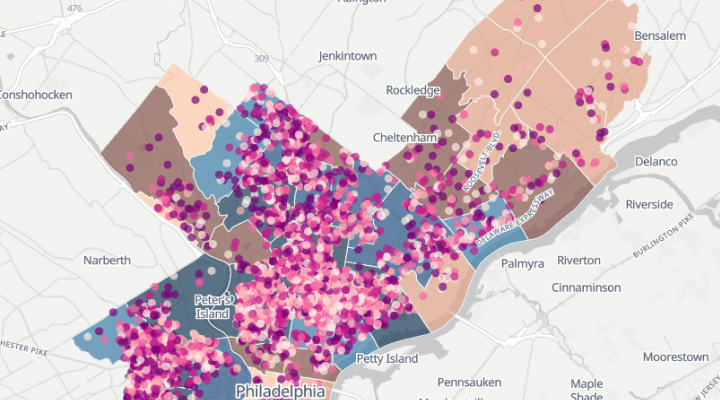

GIS tax maps are digital representations of a jurisdiction’s land parcels, incorporating a wealth of information beyond simple boundaries. They visually depict property ownership, assessed values, tax liabilities, zoning regulations, and even historical data. Each parcel is assigned a unique identifier, allowing for efficient data management and retrieval.

The Benefits of GIS Tax Maps: A Multifaceted Advantage

The implementation of GIS tax maps brings a multitude of benefits, streamlining processes and enhancing decision-making across various sectors.

-

Improved Accuracy and Transparency: GIS tax maps eliminate the ambiguity often associated with traditional paper maps, providing precise property boundaries and eliminating discrepancies. This transparency fosters trust between taxpayers and government agencies, ensuring fairness and accountability.

-

Enhanced Assessment and Valuation: The detailed information on GIS tax maps facilitates accurate property valuations, ensuring that taxes are levied fairly based on market value. This eliminates the need for manual inspections and subjective assessments, leading to more equitable tax burdens.

-

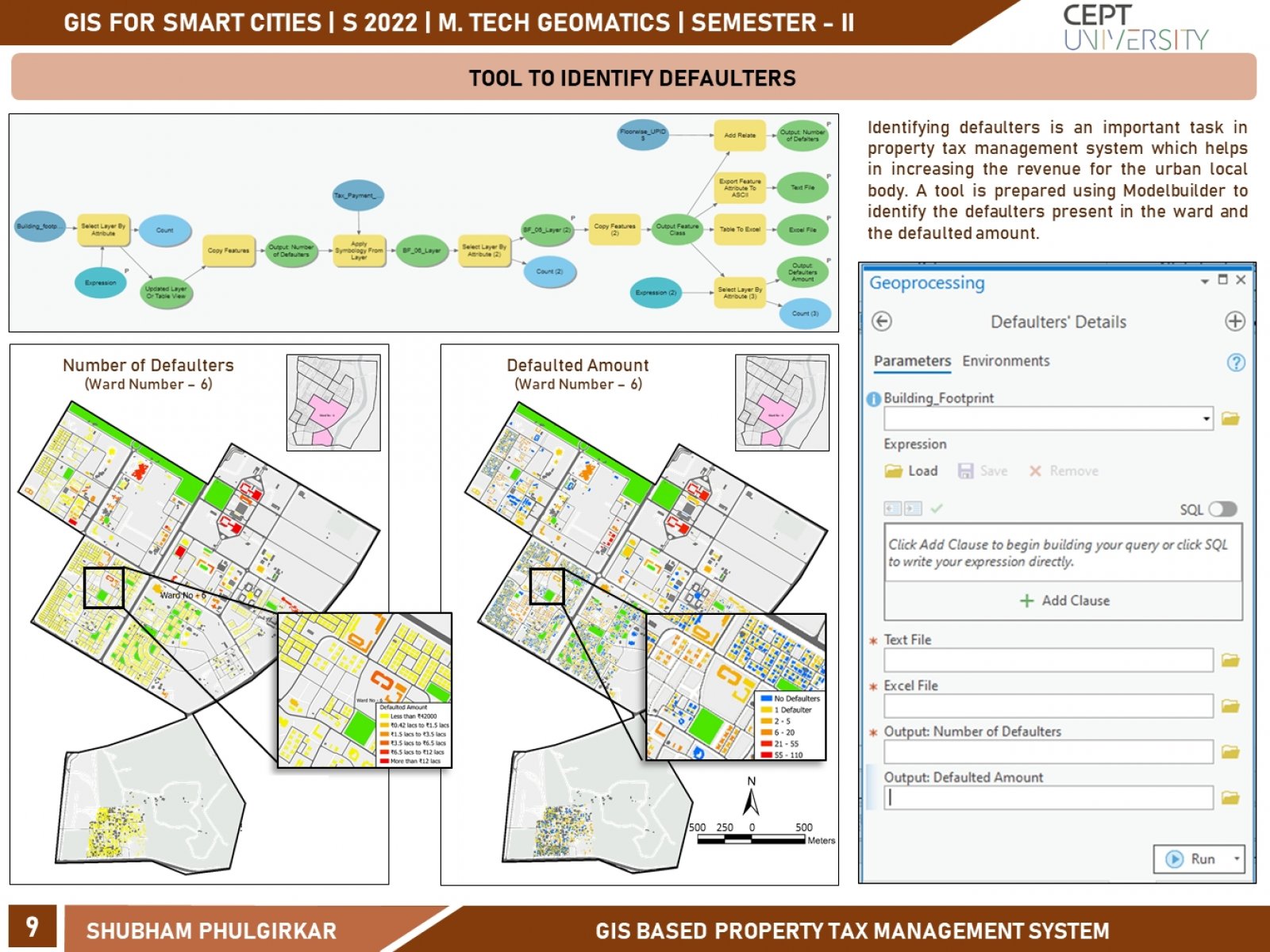

Streamlined Tax Collection: By integrating tax data with GIS maps, authorities can efficiently identify delinquent taxpayers and implement targeted collection strategies. The visual representation allows for rapid identification of properties with outstanding payments, facilitating prompt action and reducing revenue loss.

-

Effective Planning and Development: GIS tax maps provide invaluable insights for urban planning and development initiatives. By analyzing property data, officials can identify areas with high tax revenue potential, prioritize infrastructure development, and allocate resources efficiently.

-

Efficient Property Management: Property owners benefit from GIS tax maps by gaining access to accurate information about their land, its value, and any associated tax liabilities. This empowers them to make informed decisions regarding property transactions, development plans, and tax compliance.

-

Disaster Response and Emergency Management: During natural disasters or emergencies, GIS tax maps become crucial for coordinating rescue efforts and allocating resources effectively. The detailed information on property ownership, infrastructure, and vulnerable areas enables swift response and minimizes damage.

Beyond the Basics: Exploring Advanced GIS Tax Map Applications

GIS tax maps are not limited to basic property information. They can be further enhanced to include:

-

Environmental Data: Integrating environmental data such as soil types, water bodies, and protected areas provides a holistic perspective for land management and conservation efforts.

-

Infrastructure Data: Mapping utility lines, roads, and other infrastructure components allows for efficient planning and maintenance, preventing disruptions and ensuring public safety.

-

Demographic Data: Linking population density, income levels, and other demographic factors to property data enables targeted social services and community development initiatives.

FAQs: Addressing Common Concerns and Queries

1. What are the challenges associated with implementing GIS tax maps?

Implementing GIS tax maps requires significant investment in technology, data collection, and training. Ensuring data accuracy and consistency is crucial, requiring ongoing maintenance and updates.

2. How do GIS tax maps ensure data privacy?

GIS tax maps can be configured to display only publicly available information, safeguarding sensitive personal data. Access to detailed information is typically restricted to authorized personnel.

3. How can I access GIS tax maps in my area?

Many government agencies and municipalities make their GIS tax maps publicly available online. It is recommended to contact your local tax assessor’s office for specific information and access instructions.

4. What are the future trends in GIS tax map technology?

Advancements in cloud computing, artificial intelligence, and 3D modeling are transforming GIS tax maps. Future iterations will likely incorporate real-time data updates, predictive analytics, and immersive visualization tools.

Tips for Effective GIS Tax Map Utilization:

-

Data Accuracy and Validation: Ensure data integrity by implementing quality control measures and regularly updating information.

-

User-Friendly Interfaces: Design intuitive interfaces that are accessible to both technical and non-technical users.

-

Integration with Other Systems: Integrate GIS tax maps with other relevant databases to enable seamless data sharing and analysis.

-

Training and Support: Provide comprehensive training programs for users to maximize their understanding and utilization of GIS tax maps.

Conclusion: A Powerful Tool for Modern Governance and Development

GIS tax maps are a powerful tool for modern governance, enabling efficient property management, equitable taxation, and informed decision-making. By harnessing the power of visual data, they foster transparency, accountability, and sustainable development. As technology continues to evolve, GIS tax maps will undoubtedly play an increasingly crucial role in shaping our cities, communities, and the future of land management.

Closure

Thus, we hope this article has provided valuable insights into The Power of Data: Unveiling the Importance of GIS Tax Maps. We thank you for taking the time to read this article. See you in our next article!